Posted by

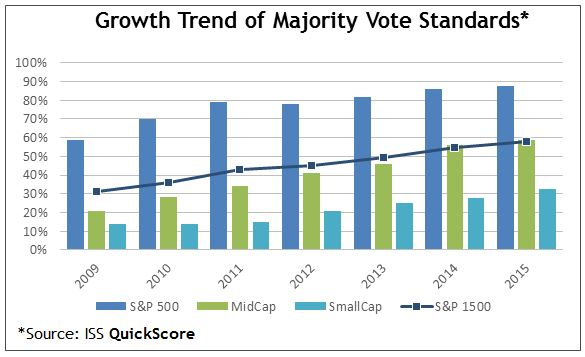

Based on analysis of public filings (primarily proxy statements) related to shareholder meetings occurring from July 1, 2014, through June 30, 2015, the study reports that annual board elections and majority vote standards for those elections are now the norm across the S&P 1500. While larger companies initially led the way in adopting these accountability enhancements, the pace of abandoning staggered board terms at smaller companies picked up speed in 2015. Also, Small- and MidCap companies adopted majority vote standards for board elections at a faster pace than their S&P 500 counterparts in 2015—increasing by 4 and 3 percentages points, respectively among the Small- and MidCap firms. For the third consecutive year, well over half of all study companies have majority voting standards, which is now the clear market standard at S&P 500 companies, with over 88 percent of companies in the index having adopted the practice. Only 61 total S&P 500 companies maintain a plurality vote standard, down from 67 last year and 87 in 2013.

There has also been a significant increase over the last five years in the number of companies holding annual elections, both at the S&P 1500 and at each constituent index. The proportion is significantly higher at S&P 500 companies, where it has risen more than 20 percentage points in the last five years. Still, over 60 percent of S&P 1500 companies (and over 80 percent of S&P 500 companies) now hold annual elections for all directors, While the prevalence has increased in the S&P 1500 every year since 2009, the largest jump occurred last year, when it rose from 60 to 64 percent, driven by an 8 percentage point increase at the S&P 500, where only 84 boards now hold staggered elections.

Many companies completed the gradual removals of their classified board structures that had begun in response to a large wave of shareholder proposals offered in a campaign organized by the now defunct Shareholder Rights Project at Harvard Law School. A majority of SmallCap companies held annual elections for the first time in 2014, a trend that has continued, as an additional 2 percent of the index’s companies held annual elections in 2015. Bucking the trend were the MidCap companies, which showed a slight decrease in the proportion holding annual elections in 2015, after steading increases in 2009 through 2014.

Board Diversity

Many corporate governance experts believe that the interplay of different backgrounds and perspectives enhances the effectiveness of boards and facilitates greater long-term corporate success. Some advocates for board diversity believe that a “tone at the top” will penetrate the corporate hierarchy and lead to increased diversity across all ranks of employment.

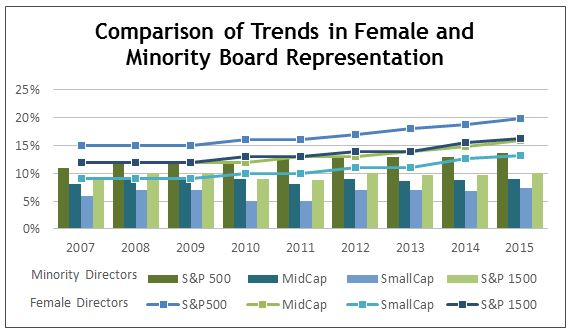

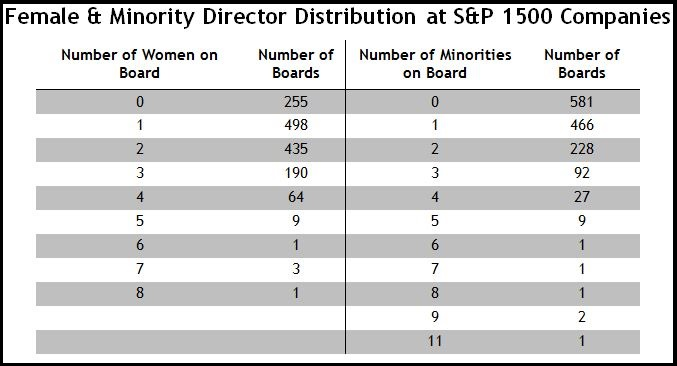

Companies with larger market caps generally have higher levels of gender and racial/ethnic diversity than those with smaller valuations. As of ISS’ latest analysis, almost all S&P 500 companies have at least one female or minority director, while 90 percent of MidCap boards and 78 percent of SmallCap boards have at least one female or minority member. There has been a market-wide increase over the past five years in board diversity:

Companies with larger market caps generally have higher levels of gender and racial/ethnic diversity than those with smaller valuations. As of ISS’ latest analysis, almost all S&P 500 companies have at least one female or minority director, while 90 percent of MidCap boards and 78 percent of SmallCap boards have at least one female or minority member. There has been a market-wide increase over the past five years in board diversity:

- Ninety-eight percent of S&P 500 boards have at least one female member and 79 percent have at least one minority, up from 89 and 63 percent in 2010, respectively;

- Eighty-four percent of MidCap boards have at least one female member and 53 percent have at least one minority, increased from 74 and 36 percent in 2010, respectively; and

- Sixty-nine percent of SmallCap boards have at least one female member and 41 percent have at least one minority, increased from 54 and 22 percent in 2010, respectively.

More than 88 percent of S&P 1500 companies have at least one female or minority director, and a majority of the S&P 1500 have either one female and/or one minority, who, in some instances, are the same individual. Minority women hold 329 directorships, an increase from 279 in 2014. Although this represents an absolute increase, the proportion of S&P 1500 directorships held by minority women has remained at approximately 2.4 percent since 2010.

New Directors

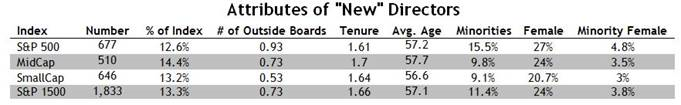

In 2015, 1,833 seats, or about 13.3 percent of all directorships, were filled by directors with less than two years’ tenure and who were elected for the first time in 2014 or 2015 (“new” directors). That compares with about 12 percent of all directorships filled by “new” directors in last year’s analysis, suggesting a slight increase in the turnover rate. The characteristics of these new directors were analyzed to develop a better understanding of what companies may be considering when choosing new director candidates.

New directors are generally younger than directors with tenures of over two years. Also, the average age difference is 5.3 years, an increase from 2014.

New directors are generally younger than directors with tenures of over two years. Also, the average age difference is 5.3 years, an increase from 2014.

Fifty-three percent of new directors serve on only one board, which continues the trend identified in last year’s study, which found that nominating committees are bringing on directors who have no prior board experience. However, a majority of open S&P 500 positions, 56 percent, were filled by a director who sits on at least one other board, which drives the “average” number of outside boards for new directors up to nearly one and underscores the fact that market leading companies seek directors with a track record. New directors are more likely than those with more than two years tenure to be outside hires; 46 percent of all directors joining boards in 2014 and 2015 sit on only one board and are not executives of the companies whose boards they have joined.

Similarly, the percentage of new directors who are female or identified as an ethnic/racial minority continues to exceed the proportion of longer-tenured female- and minority-held S&P 1500 directorships. While the proportion of new directorships held by females has increased for several consecutive years, this momentum seems to be slower for minority directors. Minority directors comprised 16 percent of new directorships in 2015, compared to 10 percent of all new directors in 2014. Female directors filled 27 percent of new directorships in 2015, up from 22 percent in 2014, and 20 percent in 2013. This increase highlights both the overall growth in the number of directorships held by women and the acceleration in the growth of female directorships.

No comments:

Post a Comment